New F&B owner FAQ: How many foreign workers can I hire?

Your foreign worker quota can be confusing because there are different permits and levies, depending on nationality and skill level.

First, it depends on the number of full-time local employees you have (the quota is a percentage of the number of local workers you hire).

Second, you have to pay a monthly levy for each foreign worker employed, and this levy is tiered.

Which levy tier depends on the number of foreign workers you have in employment – the closer you are to the maximum quota, the higher the levy.

So what combinations of local and foreign workers will be enough for your manpower needs?

Before we begin, some basics you need to know

1. Types of work passes/ permits available

Employment pass: For professionals, managers, and executives. Candidates must earn at least $3,600 a month. No quota/ levy.

S Pass: For mid-level skilled staff. Candidates need to earn at least $2,200 a month.

Work permit: No minimum qualifying salary. Valid for up to 2 years.

Dependant’s Pass: For spouse or unmarried children under 21 years of eligible Employment Pass to S Pass holders.

Dependants of Employment Pass holders can get a Letter of Consent to work in Singapore if they find a job here.

Dependants of S Pass holders will need to apply for a Work Permit, S Pass or Employment Pass instead. They will have to meet the eligibility criteria for these passes.

2. Levy (Tiered)

As long as you employ work permit holders, you will have to pay the levy, which starts from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier.

The levy payment is via GIRO and will be deducted on the 17th of the following month.

If you don’t pay the full levy on time, you may face the following penalties:

You will be charged a late payment penalty of 2% per month or $20, whichever is higher, for late payment.

Your existing Work Permits will be cancelled.

You won’t be allowed to apply for or issue Work Permits, or renew existing Work Permits.

You may face legal action to recover the unpaid levy.

If you, your partners or directors head other companies, these companies will not be allowed to apply for Work Permits.

Read about levy waivers here http://www.mom.gov.sg/passes-and-permits/work-permit-for-foreign-worker/foreign-worker-levy/apply-for-levy-waiver

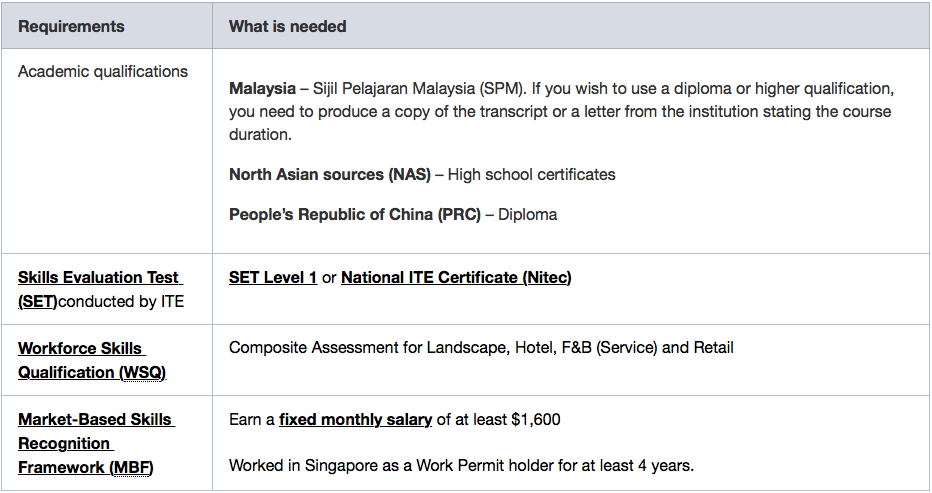

3. The levy for higher skilled workers is cheaper

4. Non-Malaysian work permit holders require a security bond

You need to buy a security bond of $5,000 before the worker arrives in Singapore.

The bond is in the form of a banker’s or insurance guarantee to support the security bond.

It will be forfeited if you violate conditions such as failing to pay salaries on time, failing to send employee back when work permits are expired or revoked, or if your worker goes missing.

5. The foreign worker quota (based on the number of local employees)

Your foreign worker quota is calculated based on the latest 3-month average number of local employees in your company. Use the foreign quota calculator to find out how many you can employ.

Any late or non-payment of CPF contributions will affect your quota and may cause your workers to be allocated higher levy tiers.

Local full-time employees are defined as Singaporeans or PRs under a contract of service with a minimum salary of $1,100/ month. 2 local part-time employees (earning $550 - $1,099/ month) count as 1 full-time employee.

The company director is considered a full-time employee if he/ she earns at least $1,100.

Business owners of sole proprietorships or partnerships and employees who receive CPF contributions from three or more employers are not counted when calculating your foreign worker quota.

6. For newly set up companies

If you haven’t made any CPF contributions yet, your quota for first month will be calculated based on your first CPF contribution, instead of the normal 3-month average.

Examples of F&B setups

and the number of foreign workers you can employ

Kiosk/ cafe with no seating, takeaway only

No. of employees needed: 3 (2 in the outlet on any given day)

Breakdown: 1 local full time employee, 1 work permit holder (Levy = Tier 3, $800/mth), 1 PT

Small cafe with seating (no hot kitchen)

No. of employees needed: 5 (min. 3 in the outlet on any given day)

Breakdown: 2 local FT, 1 work permit holder (Levy = Tier 2, $600/month), 2 PT (equivalent to 1 FT local)

Small restaurant/ bistro

No. of employees needed: 4 BOH (3 cooks, 1 dishwasher) + 4 FOH

Breakdown: 3 local FT, 2 work permit (Levy = 1x Tier 2 + 1x Tier 3 = $1400), 3 PT (equivalent to 1.5 local FT)

Full-service restaurant

No. of employees needed: 6 BOH (4 cooks, 2 dishwashers) + 6 FOH

Breakdown: 6 local FT, 4 work permit (Levy: 1x Tier 1 + 1x Tier 2 + 2x Tier 3 = $2650) , 2 PT

7. Working hours

Employees are not allowed to work more than 12 hours per day.

Off days: You must provide at least 1 rest day per week. If the rest day is not a Sunday, you should prepare a monthly roster and inform your employee of the rest days before the start of each month. The maximum interval allowed between 2 rest days is 12 days.

Cheryl Tay is the editor and marketer at iCHEF Singapore. She also manages iCHEF Club, a growing community of F&B owners in Singapore – organising events, the blog, an online newsletter and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she attempts to read every book that’s ever won a literary prize and watches cat videos. Like any proper Singaporean, her love for food runs deep – especially spicy food. Chili is life.