Some may question the importance in creating a restaurant schedule for their employees, how it would affect the business if not done right and how to go about creating staff schedules. Creating a restaurant staff schedule is tricky as Employers/Managers have to ensure that there is a balance of working hours for your staff (Full-timers and Part-timers) to ensure fairness, to minimize headcount needed (to reduce manpower costs) and to also take into account of the volume of customer in the F&B establishment.

Getting ourselves warmed up, Employers/Managers must remember this key essence when creating schedules for the week.

Part-time employment: No more than 35 hours per week

1. Why is there a need for a restaurant schedule?

The restaurant staff schedule, AKA Duty Roster is a MUST in F&B businesses. Your staff need to know ahead of time when they will be working and the establishment needs to be adequately staffed to meet customer demands. Ideally, it should balance out the different skills of each employee, and also manage employees' productivity. Poor scheduling of the duty roster may result in an increase in customer complaints, workplace stress, lower productivity, and reduced employee morale.

You should also take into account peak and lull periods, and that weekends and public holidays usually mean more hands on deck. Orchestrating a restaurant staff schedule is usually the responsibility of the manager and head chef, but F&B owners should be aware of how they are making these scheduling decisions.

2. How do we ensure poor scheduling does not happen?

Most employers plan their restaurant schedule weekly to reduce the number of changes to be made.

Here are a few things Employer/ Managers have to consider when creating schedules:

Peak Period Projections based on sales - Employers/Managers can look at the experience of their staff. Place experienced staff during peak hours like lunch periods to prevent workflow issues. Placing too many new staff on the same shift may result in the lack of coordination, especially during busy periods. A team leader, supervisor or manager should be present at every shift.

Time off request - Employees work 6 days a week and according to MOM regulations, Employers must provide 1 off day per week. Employers can spread employee's time off over the week and they cannot compel employees to work on their rest day. Exceptions can be made when the restaurant is really understaffed and the staff on duty are unable to cope. In this case, the Employer has to provide employees another day off to make up for it.

Click here to calculate rest day pay if employees work on their rest day.Staff availability - Before creating schedules, Employers should consider staff’s requests for time off before allocating them working days.

Send schedules before the start of the week - Send schedules in on Friday/ Saturday night so that employees can prepare themselves for the week ahead and make personal plans on their rest day.

3. Lunch/Dinner breaks

Typically, a full shift lasts 11 -12 hours a day, from opening to closing (It depends on the opening hours and closing hours of the F&B establishment) and Employers must provide a break time for employees who continuously work up to 8 hours a day. Meal time breaks should last at least 45 minutes. The number of hours for break time differs from each individual F&B establishment as it depends on how much time the Employer/Manager allocates. In an F&B setting, meals (sometimes known as staff meals or family meals) are commonly provided for everyone working on that day and staff should inform chefs beforehand if they have any dietary restrictions.

4. Full / Part - Time Employment

Full-Time

Full-timers refers to employees working 6 days, ≤ 44 hours per week. Employers can put in place the “Give and Take Basis” rule to ensure fairness to employees: there are times full-timers can get their requests 1 off days for the week, and times where their request cannot be granted. Requested off days cannot be guaranteed as the manager has to take into account other staff’s schedules and preferences too.

On days that the employee does not turn up for work, Employers can calculate the incomplete month’s salary here.

Part - Time

Part-timers refer to employees working under 35 hours per week which also means that they have more freedom in choosing the duration and number of days they want to work. Jobs performed by part-timers include serving, bartending, and cashier duties. Employers pay part-timers by the number of hours and days they work per month.

Employers can use this to calculate their staff hourly basic pay.

5. Steps to creating a schedule

Below is an example that Employers/Managers can follow if done traditionally:

Step 1: Lay out the schedule format

Pull out an excel sheet, list down the dates for the week, names of employees according to their job scope at the side in alphabetical order. It is easier for staff to view their schedules when it is organized in columns.

Step 2: Identify staff count needed for each shift

Plan the schedule based on peak period projections, time-off requests of employees.

Typically, staff would come in prior 30 minutes to 1 hour before the opening hours of the cafe/restaurant to prepare everything needed for lunch service. This must be made clear to all staff to ensure that they turn up for their work on time. The time listed in the staff schedule should include the preparation time. (E.g. OMONI cafe operating hours start at 9 am. The schedule should indicate that work begins at 8.30 am.)

New staff have to be taught/trained in order to understand the operations of how the F&B establishment works. As such, Managers have to turn up 30 minutes before the time on schedule to teach the new staff on the ropes of the F&B business operations - Menu, Table arrangement, Greeting of customers, Serving of food etc. New staff can come in 30 minutes before the time on schedule to familiarize themselves, get to know the menu, how to serve the customers, understand table arrangements in the F&B outlet.

Based on the size of the F&B business, different numbers of staff are required. One example we can use is a small cafe - Peak period: Lunch crowd. Employers/Manager planning schedules must ensure that there is at least 3 staff on duty for the opening - 2 back of house crew doing preparations in the kitchen, 1 front of house to set up tables and the POS system. For peak periods, it is recommended to have 6 staff on duty- 3 in the back of house, 3 in the front of house. For non-peak period, you can reduce your number of staff to 4 - 2 back of house, 2 front of house. This can help to minimize your manpower cost.

Step 3: Calculate the number of hours

Creating a schedule is important as it helps employers to manage the payroll process. Schedules are used to track and determine the number of hours an employee works and Employers/Managers use it to determine how much to pay the employee based on the number of hours logged in.

Employers/Managers have to check and calculate the number of days and hours set for the employees - Full-timers must not exceed more than 6 days, 44 hours and Part-timers must not exceed 35 hours per week. If a full-time staff’s working time exceeds 44 hours per week, Employers/Managers have to amend it as the extra hours will be counted as overtime and have to be paid at 1.5x. Since 30-40% of the restaurant revenue usually goes to manpower,it is important to ensure that the number of hours employees worked fits within the manpower budget. All salaries will have to fit within that range so it will provide the Employer/Manager an idea on how much they can set aside for part timers. If the budget is exceeded, the restaurant would not be making enough profits.

To increase the efficiency of scheduling and payroll calculations, a Human Resource Software can be used. It will allow employers to monitor employee attendance, number of hours worked, off days and medical leave, and even CPF calculations. Instead of putting in requests for days off on Whatsapp group chats, which can be messy when keeping track and open to dispute, and having to send the schedule to each individual, everything can be updated and accessed via an app so both the management and employees are on the same page.

Below is an infographic that summarizes on how to create a restaurant schedule:

In essence, the process of creating employees' schedules might be tricky but spending time to understand and create a staff schedule will aid in better operational efficiency of your F&B establishment, managing your employee's attendance, and providing better service to your customers.

This article is written in collaboration with HRMLabs, an HR system for SMEs, that streamlines attendance-taking, shift-scheduling, leave management, and more.

Caroline Yap is the editor and intern at iCHEF Singapore. She manages iCHEF Club, a growing community of F&B owners in Singapore – organizing events, an online newsletter, and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she loves drawing, painting, and creating new visuals. Her love for Korean food runs deep such that you can spot her at any famous Korean Restaurant in Singapore.

Understanding the rules and regulations before hiring employees is vital to ensure that you do not place yourself in a precarious position. Employees are the face of your F&B business as they are how customers view your “brand” as a whole. As such, investing time and effort in your hiring process can bring your F&B business to greater heights and minimize staffing issues.

Here’s an overview of the rules and regulations:

Legal Age restrictions for:

SG/PR’s: 17 years old

Foreign workers: 18 years old

Working hours:

All FT/PT can only work for 6 days a week, not more than 44 hours per week

Validity of employment passes for foreign workers:

1-2 years, A levy will be charged on employees for S and work permit employees

To find out more, you can read it here.

Steps to Find Great Employees for Your F&B Business

1. Job Postings

There are various ways for employers to find their potential employees. Before advertising on job posting platforms, employers should draft out and create an employee profile to determine the types of employees you want to hire.

The employee profile should consist of:

Experience needed to fulfill the requirements of the job

E,g. Managers, Chef roles - Proven F&B management experience through certificates or through past experienceTraits required for the role

When hiring front of house employees, it is important to look for the one that has great soft skills and attitude. Front-of- house also refers to staff that represents the “Face” of the company and they perform Managerial , Bartending, Waiters/Waitressing, Cashiering roles.

E.g. A Manager role - Patience, Ability to hide their moods, Teamwork, Good Communication skills, Able to resolve problems efficiently.

Click here to find out on the skills framework for front of house staffWhen hiring Back-of-house employees, it is important to look for people with BOTH soft and hard skills. Back-of-house refers to staff who work in the kitchen and normally, customers do not see them. Such roles include Cook, Commis Chef, Dishwasher, and etc. roles. Soft skills here refers to teamwork and communication skills, while hard skills refer to the relevant cooking and baking skills.

E.g. For a Chef role - Creativity, Attentive to details, Organizational skills, Able to work for long hours

Click here to find out on the skills framework for back of house staffCore values of the employee - If core values of the applicant coincides with the F&B business, chances are that the person will be willing do their best for the business

After identifying the criteria of your future employee, you can now work on creating job postings.

Once job postings are completed, Employers/ Managers can use these job posting platforms to find employees::

Gumtree

JobCentral

JobStreet

Monster

YY Part Time Job

Facebook (on your Business page)

Telegram (@sgcareers, @singaporeparttimejobs, @sgjobsspace_hotelfnb, @sgparttimers, @sgquickjobs)

Other than the platforms listed above, employers can use social media (Facebook and Instagram) to source for their potential employees.

For example, Most of the Stickies Bar staff are youths and young adults. As such, to gather their applicants for hire, they have opted for social media as a platform. Such platforms are Facebook, Instagram, Telegram which are popular among many young adults.

Referred candidates usually turn out to be more reliable – so you should consider referrals from friends, family, and colleagues.

2. Conducting Interviews

Moving onto the next step which is to select the right person for the job. Book an appointment date and arrange a meeting to speak to the selected ones.

This can be done at the F&B outlet or through an online platform such as Zoom/Skype. During the interview, it is important to tell the prospect hire of the company culture - How does the company function, the goals and mission of the company etc. This would provide an overview for the applicant to know what they are getting themselves into which can help in deciding whether their goals align with the company.

Questions Employers can ask when hiring

When hiring managers, Employers can ask questions such as:

Have you participated in opening a new restaurant, and if yes, what was your role?

How would you handle a dissatisfied customer?

How do you balance quality and minimize costs for the restaurant?

Tell me a time where you had to deal with a stressful situation and how did you overcome it?

Hiring a pastry chef, Employers can ask questions such as:

“ What are your past experiences as a pastry chef?”

“ Why do you want to work for Rad Bakery as a pastry chef?”

“ What are your expectations that you set for yourself?”

Employers may also request chefs to demonstrate their cooking skills which allow employers to observe the way they work and then taste the food that they prepared to determine if he/she hits the mark.

Through evaluating their previous experience, body language, and responses from the candidate, employers can determine if the person is suitable for the job. Besides that, it is important to note that employing based on skills is as important as having the right attitude, the willingness to learn and taking up new challenges.

3. Hiring of employees and Signing of Contract

After selecting the right person for the job, invite them to the F&B outlet and speak to them.

To avoid miscommunications from occurring, Employers must clearly state:

The Job Responsibilities, Dress Code, Vacation, Annual Leaves, and Remuneration

The starting date for the employee

Benefits agreed upon the employer (Health insurance, free staff meals)

Beyond technicalities, Employers can speak to the new hire on the company rules, hygiene rules, expectations they have for them and how the new hire’s work will be valued and how it can contribute to the team.

Signing of Employment Contract

Once the new hire agrees to accept the job, Employers MUST provide a contract for the employee to sign. To prevent misunderstandings from occurring, the signing of a contract must be done in person and NOT through an online platform.

The contract of employment must mention:

Appointment position

Working schedule

Probation clause

Job responsibilities

Remuneration package

Employee benefits

Code of conduct

Termination

*To read more about what goes into a written contract, click here

Once the contract is signed, Employers can welcome them onboard with the team and pass the work uniform for the new hire to wear on their first day of work.

You may save this infographic for easy reference:

4. Managing New Hire On-boarding and Team Expectations

New Hire On-boarding

Employers should introduce and provide the new hire an idea of the hierarchy of the team - Managers, Head Chef, Sous Chef etc.

By understanding the hierarchy of the team, it helps the new hire to :

1. Know who they can speak to if they have any questions/ when they encounter problems

2. Be respectful and familiarize themselves with their colleagues - this will be beneficial to the team and the F&B business.

Providing training

Employers may also provide training for the new hire by requesting them to turn up for work an hour earlier on their scheduled working dates to guide him/her on how the operations work in the F&B establishment. Some of such training include counter and table service, kitchen preparations etc.

(E.g. Opening hours of OMONI CAFE : 9 am, staff may be asked to report to work at 8 am to familiarize themselves with its operations and to help out with preparation work)

Employers have to monitor and track the employee’s training to ensure that the employee is benefiting from it and his/her skills has improved.

Managing Existing Team Expectations

Employers should never forget about his/her existing team – give a heads up to your existing team that you are hiring an additional helper to better prepare the team. This would not come off as a shock when the new hire turns up for work.

If the team and the employer has a group chat, he/she should add the new hire into the group chat and facilitate by introducing the new hire’s name, position in the restaurant, and his/her starting date to the team so that they can get familiarized with the new staff easily.

Employers can also allow and encourage their existing staff to voice out to them if there any concerns pertaining to the new hire's work performance, attitude along the way.

“Time well spent is an investment of the present for a practical and abundant future.”

All in all, allocating time and effort in finding the right staff for your F&B Business. It is vital as it not only allows you to increase your business efficiency, productivity, it also helps to retain your existing staff.

This article is written in collaboration with HRMLabs, a HR system for SMEs, that streamlines attendance-taking, shift-scheduling, leave management and more.

Caroline Yap is the editor and intern at iCHEF Singapore. She manages iCHEF Club, a growing community of F&B owners in Singapore – organizing events, an online newsletter and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she loves drawing, painting and creating new visuals. Her love for Korean food runs deep such that you can spot her at any famous Korean Restaurants in Singapore.

This is a highly sensitive topic that most employers struggle with. As an F&B owner, you have to make difficult decisions that benefit the company as a whole. Besides that, it is vital to manage the emotions of the employee being terminated as well as the other employees.

Terminating employee employment should be every F&B employer's last resort after multiple reminders and warnings. While it is never easy to deliver the bad news, here are some tips to manage the process.

The factors of dismissal can be categorized under 2 categories:

Required to provide a notice period and Not required to provide a notice period

Required to provide a notice period

1. Performance

Before taking action to fire the employee, provide constructive feedback, training, and monitor their performance. If performance is consistently below satisfaction of what is required, you can dismiss your staff.

However, you must provide the employee with a termination notice period, which is based on what is stated in the contract agreement.

In the event no notice period is stated in the agreement, you can use this as a reference:

Click Here For More Information

2. Excessive and Repeated Absence

Excessive

The number of leaves taken per month must not unnecessarily disrupt operations of the F&B. Before taking steps to terminate employees, you can observe the employee for 3 months occurrence, before deciding whether to keep or discontinue the employee contract.

(The duration indicated here are not determined or recommended by iCHEF but rather indicators based on speaking with some Employers)

Repeated Absence

If the employee does not turn up for 2 consecutive days without notice or approval, employers may terminate the employee employment

Example: Jack is a sous chef in a small restaurant. Out of a 6-day work schedule, he reports to work 3 days and does not show up the remaining 3 days. Despite constant reminders from his manager, this behavior continues. As such, he is affecting the operational capacity of the restaurant and the morale of his colleagues.

3. Punctuality

If the employee is consistently late after multiple reminders and warnings, it should ring a red flag to the employer that this employee might not be suitable for the F&B industry.

Currently there are many HR Solutions that help to automate attendance. So you can also synchronize between payroll based on attendance, so you know the performance of employees.

Not Required to provide a notice period

For cases such as these, employees should be suspended until investigations are completed.

Termination due to misconduct

You have the right to terminate the contract without notice when the employee is found guilty of the following:

1. Theft

2. Insubordination

3. Bringing the company into disrepute

4. Violation of food handling policies and procedures

5. Sexual harassment

Example: Jack punched a customer when they got into an argument. Jack was given a chance to explain his actions but he was unable to provide any reasonable explanation. As such, he was dismissed for bringing the organization into disrepute.

2. Termination against foreign employees

There are extra steps to take when employees hired under S Pass or work permits who are facing termination.

Employers MUST cancel dismissed foreign employee’s work pass within 7 days of employment termination.

1. Tax clearance (E, S and Work Permit pass)

Employers have to:

Inform IRAS one month before dismissal of Foreign Employees

Determine if they have to seek tax clearance

After IRAS performs a clearance certificate (all taxes paid), Employers can then release salary payment (OT pay, allowance, reimbursement) to the employee.

To facilitate such payroll calculation, a Human Resource Management software may be used to automatically manage each employee’s details and payroll.

2. Buy an airplane ticket to send the pass holder back to their country of residence

Dismissed employee must depart within 14 days of pass cancellation

3. Preparing employees for dismissal

The firing of employees should never be done over the phone, text, and email – doing so would be unprofessional and allow for misinterpretations. It is also fair to your staff to have a chance to voice out what they are feeling.

Follow the steps below to ensure that the dismissal is a proper one:

Setting of employee expectations

Ensure that your employee is aware of the agenda of the meeting beforehand so that it does not come as a shock to them.Arranging of termination meeting

Ensure that the meeting place is private and not done in front of other employees. It is important to respect the terminating employeeTerminating the employee

1. Do not beat around the bush. Instead, go straight to the point and use simple words that can be easily understood

Example, “ Unfortunately, this will be your last day working with us,”2. Be transparent with the employee by stating the reasons why you are terminating their employment

For example, Jack, I am terminating your employment as:

1. Your attendance is poor and we have mentioned this a few times, and despite this there have been no improvements. This consistently violates our company policies.

2. We have had numerous conversations about your attitude and encouraged you to improve it but we haven’t seen you make an effort to change.

Sadly, we have to terminate your employment with immediate effect.Issue termination letter

It is mandatory to:Issue a termination letter to the employee

Provide a written letter, it cannot be verbal

Issue last paycheck

Generally, employers issue the last paycheck on the day of dismissal.

If that is not possible:

You MUST issue the employee last paycheck within 3 days from the date of termination

For example, Jack's contract was terminated on 14 August 2020. His employer has to pay him latest by 17 August 2020.

4. Managing the dismissed employee’s emotions

Treat laid-off employees with respect and dignity as it is bound for your employees to reconnect even after leaving your company. This helps to ensure a good relationship between the employer and the remaining employees in the company.

Be compassionate towards laid-off employees. For example, if your employee was laid off due to incompetence, employers can introduce them to options to pick up new skills.

5. Managing of other employees emotions

An abrupt dismissal of an employee may open doors for other employees to speculate on the reason. As such, it is important to communicate and send a clear message to the other employees.

To avoid that from occurring, employers should:

Have a team meeting to address the issue

Be careful with the words used so as to not defame the dismissed employee and explain the reason for the employee’s termination

Ensure that the dismissed employee’s job is being covered

Be receptive to employees’ questions and concerns

Reinforce the restaurant’s expectations and policies

Praise employees who performed well

“HANDLE IT RIGHT”

Being honest with the laid-off employee is vital as leaving them with unanswered questions about their dismissal will result in you being suspicious on wanting to cover it up. This process will take a long time but you will have to handle it right to ensure no hard feelings are left on both parties.

This article is written in collaboration with HRMLabs, a HR system for SMEs, that streamlines attendance-taking, shift-scheduling, leave management and more.

Caroline Yap is the editor and intern at iCHEF Singapore. She manages iCHEF Club, a growing community of F&B owners in Singapore – organising events, an online newsletter and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she loves drawing, painting and creating new visuals. Her love for Korean food runs deep such that you can spot her at any famous Korean Restaurants in Singapore.

Singapore being a gastronomical country, is well known for its eateries. Everyone wants to be a boss and many would scratch their heads and ask questions like “ What roles does my F&B business need? “How many employees should I hire for my F&B business?” “How much do I have to pay my employees?”

Fret not, we will be guiding you along the way so sit back, relax and read on to solve those burning questions in your minds! Let’s start with the employees that an F&B business would typically need to operate smoothly.

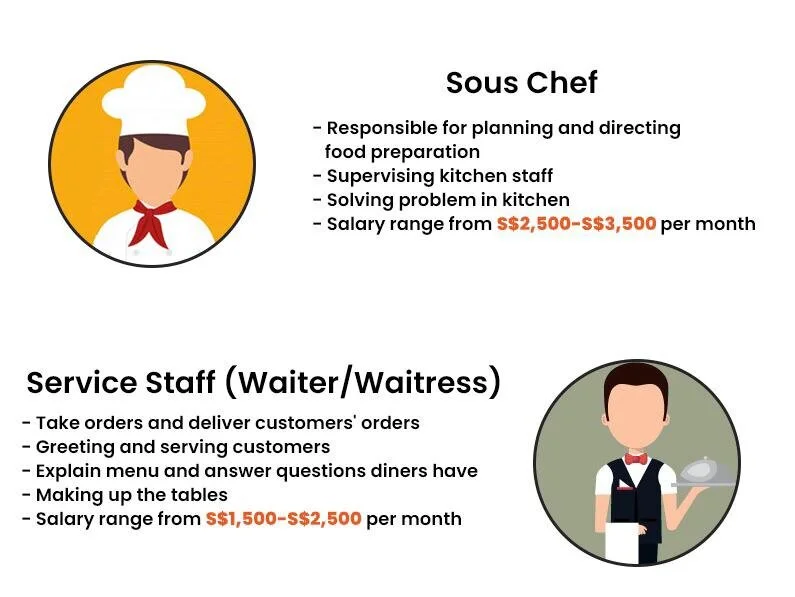

Employee Roles and Salaries

High-end restaurants with specialized skill requirements may offer higher salary scales. The salary ranges indicated here are not determined or recommended by iCHEF but rather indicators based on these sources: Gumtree, Trabajo, JobStreet, JobCentral, Indeed, Glassdoor

2. Payment of Salaries

Employers must pay their employees once a month for their service.

Salary must be paid:

1. Within 7 days after the end of each salary period.

2. For overtime work, within 14 days after the end of the salary period

There is no minimum salary for Singaporeans/ PR. However, it is important to bear in mind that there is always a demand for local F&B employees so the salaries you offer have to be competitive.

On the other spectrum, there is a minimum salary for foreign employees.

The minimum salaries are as follows:

Employment passes: S$3,900

S passes: S$2,400

Work Permit passes: S$1400

Employer CPF Contributions are only applicable to Singaporeans and PR. Employers are required to contribute their monthly share of CPF on top of their employee’s CPF.

The contributions for CPF are based on the employee’s age and total wages earned for the month.

F&B businesses fall under the private sector, as such below is the CPF contribution rates table for all F&B’s to take note of:

Example:

Jacob’s age: 20 years old.

He earns a total of S$600 per month as a Barista. As such, his employer has to contribute 17% of $600 which is S$102.

To better manage your employees salary and CPF, you can consider adopting a human resource software that will ease the steps required for payroll management.

3. Consequences of Inflating Salary and Not paying CPF

Inflating Salary: Fine up to S$20,000 per offence

Not paying CPF (First-time offence): Fine up to S$5,000 and/or up to 6 months imprisonment

Inflating Salary

It is against the law to inflating salary to secure foreign passes and the employer will be fined if found guilty. Employers MUST pay their employees based on the agreed sum in the contract

Not paying CPF

If employers do not pay their employees (SG/PR) CPF, there will be:

18% Interest charged starting from the first day of the following month after contributions are due

First-timers: A fine of S$5,000 and/or up-to 6 months imprisonment

Repeat offenders: A fine of S$10,000 and/or up-to 12 months imprisonment

If employers deduct employee share of CPF but fail to submit, the employer will receive a fine of up to $10,000, and/ or imprisonment of up to 7 years.

4. Applications of employee roles in F&B establishments

Putting what we have mentioned above together, let’s apply it to some F&B establishments.

Cafes

To run a sizable cafe serving freshly prepared meals as well as coffee, you would need to have an average of 10-15 staff to operate smoothly.

Here is the breakdown: 1 General Manager, 2 Supervisors, 1 Executive Chef, 1 Sous Chef, 1 Cook, 2 Service Staff, 1 Part-Time Dishwasher, 2 Barista

Restaurant

To run a restaurant, you would need to have an average of 15-25 staff to operate smoothly.

Here is the breakdown: 1 General Manager, 2 Restaurant Supervisor, 1 Head Chef, 1 Sous Chef, 3 Cooks, 3 Service Staff, 2 Dishwashers, 2 Barista/Bartenders.

“TOO MANY COOKS SPOILS THE BROTH ”

To sum it up, I would like to end with this principle of “ Too Many Cooks Spoils The Broth”. New F&B owners need to understand that getting the right amount of employees required for your F&B business is sufficient to operate their F&B business. Also, remember to pay your staff on time, else you won’t be spared from fines coming your way!

This article is written in collaboration with HRMLabs, a HR system for SMEs, that streamlines attendance-taking, shift-scheduling, leave management and more.

Caroline Yap is the editor and intern at iCHEF Singapore. She manages iCHEF Club, a growing community of F&B owners in Singapore – organising events, an online newsletter and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she loves drawing, painting and creating new visuals. Her love for Korean food runs deep such that you can spot her at any famous Korean Restaurants in Singapore.

Reduce your F&B manpower costs with Enhanced Training Support

While most F&B businesses are aware of the wage support (JSS) being provided by the Government, few are taking advantage of the additional support from SkillsFuture Singapore.

As eateries can only offer takeaways and delivery until 1 June, and now with beverage and dessert shops being told to close, your outlet may be a bit overstaffed at the moment – however no employer wants to tell their staff they have to leave, especially at times like this. One way to keep your staff employed is to send them for training.

Subsidised training

In order to help sector-specific SMEs like F&B during this period, the Government introduced Enhanced Training Support of up to 90% of course fees when employers sponsor employees to attend courses by SkillsFuture. This covers eligible courses with commencement dates between 1 April and 31 December 2020.

Keep staff employed

As employees attend these courses, companies will receive enhanced absentee payroll support at 90% of the employee’s hourly basic salary, capped at $10 per hour. So while employers will still have to pay a nominal sum for courses, they can benefit from absentee payroll support and reduce their manpower costs. You can calculate your employee’s hourly basic salary here.

On top of that, your staff will be equipped with new skills which can be put to use when business returns to normal.

How to qualify for Enhanced Training Support

SMEs must meet all of the following eligibility criteria:

Registered or incorporated in Singapore

At least 30% local shareholding by Singapore Citizens or Singapore Permanent Residents

Employment size of not more than 200 (at group level) or with annual sales turnover (at group level) of not more than $100 million

Trainees must be hired in accordance with the Employment Act and fully sponsored by their employers for the course

Trainees must be Singapore Citizens or Singapore Permanent Residents

SMEs can submit applications and claims through the online SkillsConnect platform at www.skillsconnect.gov.sg. ETSS will be extended to those who meet the eligibility criteria. The application can be submitted up to 30 days before the course start date and no later than 30 days after the course start date.

Subsidised Course Fees

It’s important to note that training support is up to 90%, so not all courses are subsidised equally. SSG has stated that the subsidy is for priority deep-domain skills (like culinary arts, process innovation) and emerging digital skills. Those by approved training partners such as Asian Culinary Institute, NTUC LearningHub Pte Ltd, SHATEC Institutes and Temasek Polytechnic will be subsidised by 90%.

Some examples of courses you can choose from

You can send service staff for Growing Customer Satisfaction and Service Quality in F&B by Republic Polytechnic

Your sous chef or cooking assistants can go for Prepare Mise En Place (Pastry) by Asian Culinary Institute

Supervisors can attend WSQ Manage Service Performance by NTUC LearningHub

And you can send managers/ supervisors for Surviving & Thriving In The Isolation Economy: Business Model And Technology Innovation by SMU

According to this article, the full course fee is $1,712, but with government grants or SkillsFuture credits, Singaporeans pay as little as $113.60.

How will courses be conducted amid the Covid-19 situation?

SSG has announced that all courses will be held virtually, except for courses that apply to sectors severely affected by Covid-19 (e.g. tourism, aviation, retail, food services, land transport, arts and culture) that require in-person training.

The Budget announced on 19 February includes new grants and a rise in GST, among other things. What does this mean for food businesses? And what can you do about it?

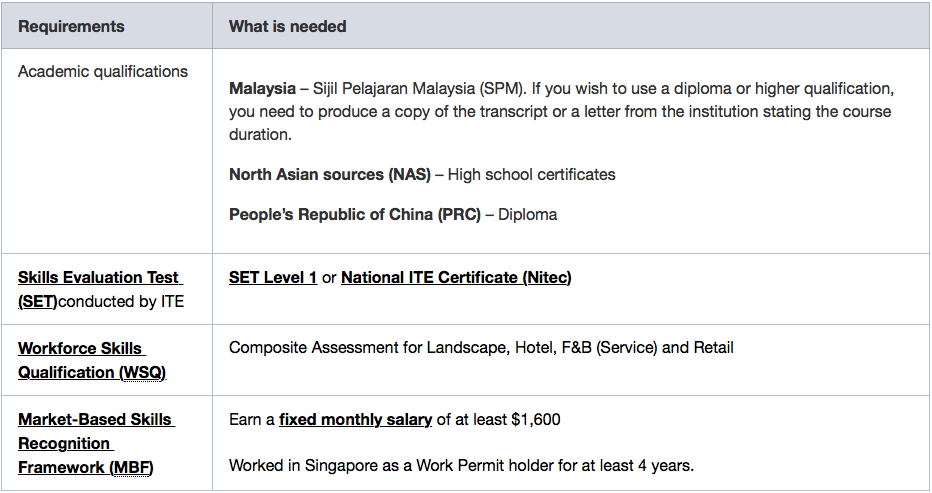

New F&B owner FAQ: How many foreign workers can I hire?

Your foreign worker quota can be confusing because there are different permits and levies, depending on nationality and skill level.

First, it depends on the number of full-time local employees you have (the quota is a percentage of the number of local workers you hire).

Second, you have to pay a monthly levy for each foreign worker employed, and this levy is tiered.

Which levy tier depends on the number of foreign workers you have in employment – the closer you are to the maximum quota, the higher the levy.

So what combinations of local and foreign workers will be enough for your manpower needs?

Before we begin, some basics you need to know

1. Types of work passes/ permits available

Employment pass: For professionals, managers, and executives. Candidates must earn at least $3,600 a month. No quota/ levy.

S Pass: For mid-level skilled staff. Candidates need to earn at least $2,200 a month.

Work permit: No minimum qualifying salary. Valid for up to 2 years.

Dependant’s Pass: For spouse or unmarried children under 21 years of eligible Employment Pass to S Pass holders.

Dependants of Employment Pass holders can get a Letter of Consent to work in Singapore if they find a job here.

Dependants of S Pass holders will need to apply for a Work Permit, S Pass or Employment Pass instead. They will have to meet the eligibility criteria for these passes.

2. Levy (Tiered)

As long as you employ work permit holders, you will have to pay the levy, which starts from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier.

The levy payment is via GIRO and will be deducted on the 17th of the following month.

If you don’t pay the full levy on time, you may face the following penalties:

You will be charged a late payment penalty of 2% per month or $20, whichever is higher, for late payment.

Your existing Work Permits will be cancelled.

You won’t be allowed to apply for or issue Work Permits, or renew existing Work Permits.

You may face legal action to recover the unpaid levy.

If you, your partners or directors head other companies, these companies will not be allowed to apply for Work Permits.

Read about levy waivers here http://www.mom.gov.sg/passes-and-permits/work-permit-for-foreign-worker/foreign-worker-levy/apply-for-levy-waiver

3. The levy for higher skilled workers is cheaper

4. Non-Malaysian work permit holders require a security bond

You need to buy a security bond of $5,000 before the worker arrives in Singapore.

The bond is in the form of a banker’s or insurance guarantee to support the security bond.

It will be forfeited if you violate conditions such as failing to pay salaries on time, failing to send employee back when work permits are expired or revoked, or if your worker goes missing.

5. The foreign worker quota (based on the number of local employees)

Your foreign worker quota is calculated based on the latest 3-month average number of local employees in your company. Use the foreign quota calculator to find out how many you can employ.

Any late or non-payment of CPF contributions will affect your quota and may cause your workers to be allocated higher levy tiers.

Local full-time employees are defined as Singaporeans or PRs under a contract of service with a minimum salary of $1,100/ month. 2 local part-time employees (earning $550 - $1,099/ month) count as 1 full-time employee.

The company director is considered a full-time employee if he/ she earns at least $1,100.

Business owners of sole proprietorships or partnerships and employees who receive CPF contributions from three or more employers are not counted when calculating your foreign worker quota.

6. For newly set up companies

If you haven’t made any CPF contributions yet, your quota for first month will be calculated based on your first CPF contribution, instead of the normal 3-month average.

Examples of F&B setups

and the number of foreign workers you can employ

Kiosk/ cafe with no seating, takeaway only

No. of employees needed: 3 (2 in the outlet on any given day)

Breakdown: 1 local full time employee, 1 work permit holder (Levy = Tier 3, $800/mth), 1 PT

Small cafe with seating (no hot kitchen)

No. of employees needed: 5 (min. 3 in the outlet on any given day)

Breakdown: 2 local FT, 1 work permit holder (Levy = Tier 2, $600/month), 2 PT (equivalent to 1 FT local)

Small restaurant/ bistro

No. of employees needed: 4 BOH (3 cooks, 1 dishwasher) + 4 FOH

Breakdown: 3 local FT, 2 work permit (Levy = 1x Tier 2 + 1x Tier 3 = $1400), 3 PT (equivalent to 1.5 local FT)

Full-service restaurant

No. of employees needed: 6 BOH (4 cooks, 2 dishwashers) + 6 FOH

Breakdown: 6 local FT, 4 work permit (Levy: 1x Tier 1 + 1x Tier 2 + 2x Tier 3 = $2650) , 2 PT

7. Working hours

Employees are not allowed to work more than 12 hours per day.

Off days: You must provide at least 1 rest day per week. If the rest day is not a Sunday, you should prepare a monthly roster and inform your employee of the rest days before the start of each month. The maximum interval allowed between 2 rest days is 12 days.

Cheryl Tay is the editor and marketer at iCHEF Singapore. She also manages iCHEF Club, a growing community of F&B owners in Singapore – organising events, the blog, an online newsletter and the F&B Entrepreneur Bootcamp, the only regular workshop on opening a new restaurant in the country. In her spare time, she attempts to read every book that’s ever won a literary prize and watches cat videos. Like any proper Singaporean, her love for food runs deep – especially spicy food. Chili is life.

Everyone knows that the key to making profit in the F&B business is high revenue while keeping operating costs low. By now you probably already know which costs are fixed (rent, for instance) and which costs you can actually control on a month-to-month basis. These are known as Prime Cost (total cost of goods sold + total labour cost) or variable costs.

One of the biggest problems F&B businesses face is manpower shortage. Hiring foreign workers has become a necessity, but it is increasingly hard to do so because of stricter quotas.